April is the Month of Changes.

Our National Insurance Contributions will increase by 1.25% from 6th April 2022 to 5th April 2023.

The government has planned to use the additional National Insurance Contributions to assist with NHS, health, and social care costs around the UK

It is mandatory to pay your National Insurance contributions if you are an employee earning above £184 each week from the age of 16 or for those who are self-employed and making a profit of £6,515 or more annually.

The increase will apply to:

- Class 1 (paid by employees)

- Class 4 (paid by self-employed)

- secondary Class 1, 1A and 1B (paid by employers)

The increase will not apply if you are over the State Pension age.

If you require more information, please visit Gov.UK

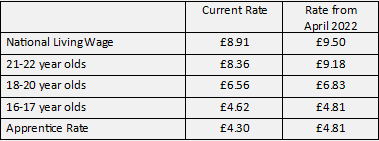

The National Living Wage & National Minimum Wage

The first year of an apprenticeships rate has had a big increase this year of 11.9%. It is useful to remember that after the first year an apprenticeship is completed the new standard NMW rates are due.

- Check and make a note of all employees over 23 who are eligible in your workplace for the new National Living Wage.

- Take appropriate payroll action.

- Inform your employees of their new pay rate.

- Check all other employees 22 and under are receiving the correct wage under the National Minimum Wage.

Please remember to check your employee arrangements and inform us at EasyBooks of any updates to your payroll rates as appropriate. Don’t forget, you as the employer are responsible for paying all your staff the appropriate rates.

EasyBooks Prices Changes – Our price increase notice

Please Note: EasyBooks will be implementing a price increase, across the board, as of 1st April 2022. This is due to the annual inflation cost.

Pension Processing Fees which will remain the same as 21/22.

Please get in touch if you have any queries or concerns regarding this matter.

Many thanks, The EasyBooks team.

- Posted by EasyBooks

- On 11th April 2022

- 0 Comments